Table Of Content

Many simply can’t afford to get on the property ladder now or even leave the family home and rent. Justin Stivers is an investment advisory representative of and provides advisory services through CoreCap Advisors, LLC. Stivers Law is a separate entity and not affiliated with CoreCap Advisors. The information provided here is not tax, investment or financial advice. You should consult with a licensed professional for advice concerning your specific situation. Making a move is a big step for everyone, despite where you may be in life.

It’s not about the money

Also, where remote work is more available to many post-pandemic, renting has become increasingly attractive. The survey of 2,000 renters in large apartment communities nationwide conducted in January found 66% say renting fits their current lifestyle more than owning a home. A third say they could afford a home in 2024 that meets their needs but choose not to buy.

Benefits and drawbacks of renting a home

It's Cheaper to Rent Than Buy a House in America Right Now - Newsweek

It's Cheaper to Rent Than Buy a House in America Right Now.

Posted: Mon, 23 Oct 2023 07:00:00 GMT [source]

But they are now in league with a whole bunch of other universities that are struggling with the same set of questions. And it’s a set of questions that they’ve had since this war broke out. So Shafik’s dilemma here is pretty extraordinary. And for those students who maybe couldn’t go back to — into campus, now all of their peers, who were supporters or are in solidarity, are — in some sense, it’s further emboldened. They’re now not just sitting on the lawns for a pro-Palestinian cause, but also for the students, who have endured quite a lot. And it’s a university on top of all that that has a real history of activism dating back to the 1960s.

Assess Your Financial Standing

And so in my time of being a reporter, of being an editor, I’ve overseen several protests. And I’ve never seen Columbia penalize a group for, quote, unquote, not authorizing a protest. So that was certainly, in our minds, unprecedented.

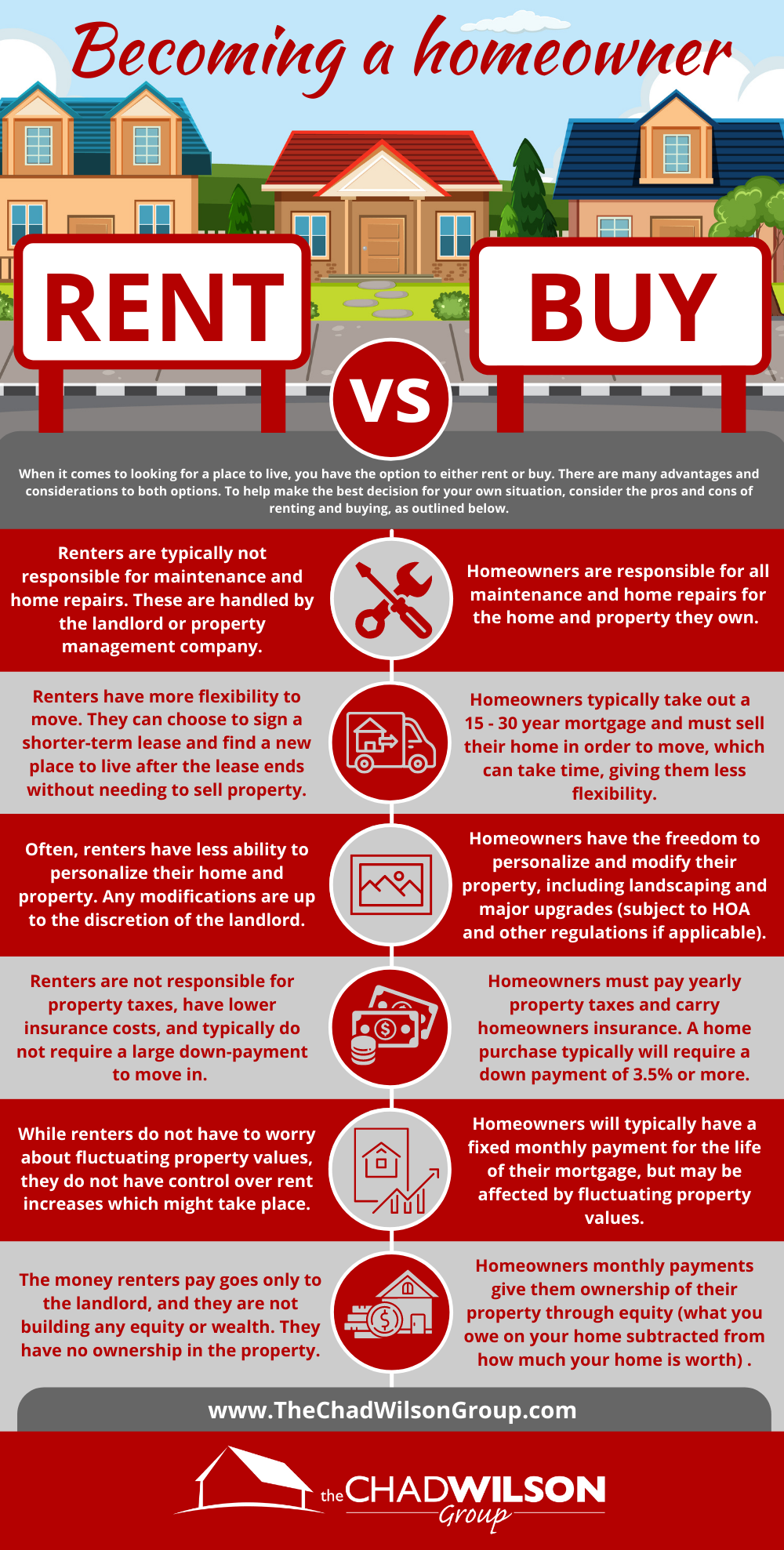

Renting vs. owning: What’s the difference?

And it says, I’m paraphrasing here, Hamas’ next targets. Can I — I just have a question for you, which is all journalism, student journalism or not student journalism, is a first draft of history. And I wonder if we think of this as a historic moment for Columbia, how you imagine it’s going to be remembered. My phone blew up, obviously, from the reporters, from the editors, of saying, oh my god, the NYPD is on our campus. And I saw a huge crowd of students and affiliates on campus watching the lawns. And as I circled around that crowd, I saw the last end of the New York Police Department pulling away protesters and clearing out the last of the encampment.

Explore Renting and Buying

If you are committed to at least 3 to 5 years or more, it’s probably in your interest to look into buying. If you long to live elsewhere, lack job security, are not ready to stay in place for at least three years minimum, renting may make more sense for you right now. You don’t earn equity (or lose it) because you do not own the home or apartment where you live. Equity, or the increase in value a home receives over time, only goes to the person who owns the property. Owning a home affords you more privacy than a rental property would, especially if you are renting in an apartment complex or a house shared with the landlord.

Buying Pros

“If it’s a declining market where prices are going down, or where the market is very uncertain, renting might be the safer way to go,” says May. For all the commitment-phobes out there, the prospect of buying a house can be daunting. It’s a big investment, and usually it’s based on a 20- or 30-year mortgage contract, unless you plan on selling before it’s paid off — and that has its own set of challenges. Renting a home comes with a lot of flexibility and freedom that’s attractive to nomadic souls as well as those with savings that are slim to none.

Should I rent or buy a house? Financial advisor weighs in on Houston's real estate market amid 2024 economy - KTRK-TV

Should I rent or buy a house? Financial advisor weighs in on Houston's real estate market amid 2024 economy.

Posted: Thu, 22 Feb 2024 08:00:00 GMT [source]

Owning involves more commitment in terms of finances, time, and labor than renting. It’s an investment and like all investments can go up or down in value. Failure to make house payments can ultimately result in losing your home and all you have invested. Failure to pay rent can ultimately result in eviction but since you don’t own the home, you don’t lose your investment.

Some decisions are out of your hands

Some property managers may require you to purchase renters’ insurance, though, which can be bundled with your auto insurance. You also have the potential of building credit if your landlord reports rent payments to credit bureaus. But the lack of responsibility renting provides comes at a cost. That requires being in a financial position to do so, and the state of the housing market can put an extra strain on your ability to buy a house. The decision to rent or own depends on your financial situation.

Deciding whether to buy a house isn’t an easy choice. That’s why it’s smart to partner with a pro who can help you navigate your options. You won’t find it as easy to move or embark on long-term travel. Buying a home is likely one of the largest investments you'll ever make in your future. It's also a huge part of most people's vision of "The American Dream."

So students who aren’t feeling safe in this protest environment don’t necessarily have to go to class. The problem with that is that, over the weekend, a series of images start to emerge from on campus and just off of it of some really troubling anti-Semitic episodes. In one case, a guy holds up a poster in the middle of campus and points it towards a group of Jewish students who are counter protesting.

But it's also about your comfort and vision for your future. Ignore people who tell you that owning always makes more sense in the long run or that renting is throwing away money. Disregard anyone who says that buying makes more sense if your monthly mortgage payment is more cost-efficient than your monthly rent payment. Housing markets and life circumstances are too varied to make blanket statements like these. You could also end up with extra cash if you choose to save or invest the money you are saving by renting instead of paying a mortgage.

No comments:

Post a Comment